High Performance Habits

Improving equity value in your business

5 min read

Let’s face it, the majority of consultants don’t like selling. And to be fair, if you enjoyed sales that much, you wouldn’t have become a consultant. However, an effective business development strategy isn’t just about sustainable revenue.

Investing in sales training and marketing activity can also dramatically increase your firm’s value.

We recently sat down with Paul Collins, chairman of the board of directors for our partner Equiteq, to discuss:

- How “taking sales more seriously” led to his consultancy being sold for more than £50m;

- Why your “career tombstone” can help you stand out in the market, even against the consultancy giants;

- The perfect time to discuss your fees.

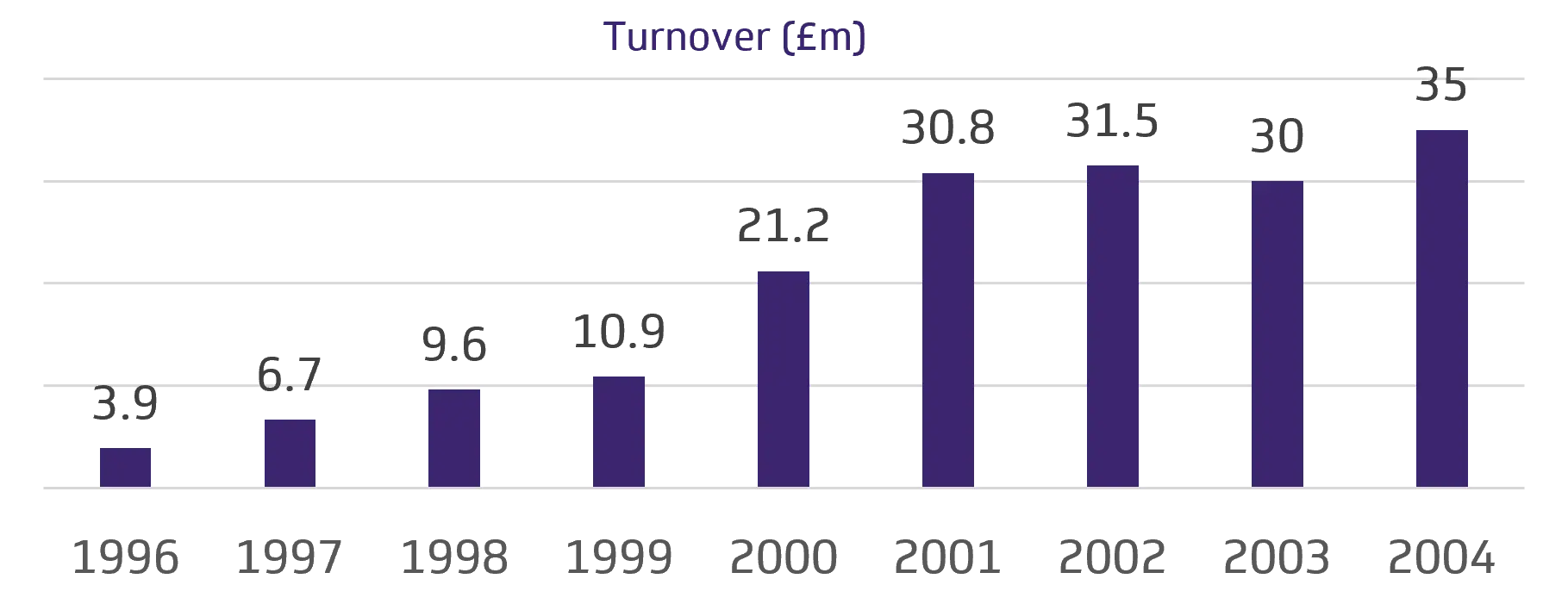

How a £28m increase in sales led to £50m equity value

Paul admits that early in his consultancy career, sales strategy wasn’t a major concern. However, once WCI, the firm he founded in 1986, took a more strategic approach to sales, it had a huge impact.

He says:

“It took almost 10 years to get to less than £5m in sales. Once we started taking sales much more seriously, we grew quite rapidly. And in 2002, we sold with an equity value of £50m.”

So what are the critical foundations for successful business development? And what are the small actions you can take to have the biggest impact?

What will it say on your career tombstone?

Before you start putting a sales process in place, it’s critical to develop a Unique Value Proposition. Your UVP is what sets you apart from other consultancy firms. It’s answering the question, “Why should a client come to you instead of one of the consultancy giants?”

Paul says:

“The answer to that should be not because you are cheaper. It should be because what you do and the services that you provide are unique.”

This could be because you offer proprietary diagnostic tools, or you specialise in a specific silo in a niche industry. What matters, Paul says, is that you can offer something that other consultancies can’t.

“I say to clients these days, unless you’ve got a strong unique value proposition, everything else is like pushing string uphill. It’s just difficult. Your ability to sell your service to a client is just so much harder if your value proposition isn’t strong.”

Or to put it another way, Paul explains:

“If you imagine your career tombstone, what’s it going to say on it? Every consultant and every company ought to aspire to have something everybody remembers your firm by.”

Highlight your UVP with thought leadership and case studies

Once you’ve nailed down your UVP, it’s important to be able to support that with a range of marketing activities. Paul says one of the best tactics is to produce case studies from your biggest clients.

“There’s a reasonable chance that your clients are bigger than you and they’re more well known. So if you can get your clients to attest to the good work that you’ve done, that goes a long way to promote your services on a global stage.”

Ideally, you want your clients to put their name to your work, however, not all organisations are happy to do this. Frustratingly, it’s often the most prestigious firms who prefer not to be named. Paul says that referring to the client in general terms (“a global technology firm based in San Francisco”) can still have the desired effect.

As well as highlighting the clients you’ve worked with and the results you’ve achieved, Paul also suggests promoting your expertise with thought leadership content. This can range from white papers, webinars, and speaking events to social media posts, as well as getting articles published on influential industry websites.

Again, Paul says that selling your services is a lot easier if prospects have already consumed your content and therefore have a good understanding of your skillset.

Focus on value rather than cost

The area where Paul feels most small and medium-sized consultancies lose business is because they are “putting a number against benefits.” It is imperative, he says, to reframe “costs” as an investment.

He goes on:

“If you’re not explicit to a CFO or a finance director, you’re not going to get anywhere. So you’ve got to express your benefits with the pound or dollar sign. You need to talk about the five-year benefits of what you’re going to do.”

Psychologically, it’s also important to discuss the financial benefits before discussing fees.

He says:

“If you don’t talk benefits before you talk costs, when you talk costs, your mouth goes all screwy and you will just not look confident.

“If you explain to your client that you’re going to save them a million pounds over the next year, then when you say that it’s going to cost them a quarter of a million pounds, it will just roll off the tongue and you will sound confident. If you only talk about the quarter of a million, it won’t sound confident.”

To discover more about improving equity value in your business, let’s talk growth.