Use historical sales data to dramatically improve win rates

Peter Drucker famously said that you can’t improve what you don’t measure. However, we’re continuously surprised by how many sales leaders base their forecasts on hunches and gut instinct rather than accurate data. As a result, they’re often wildly off the mark. In fact, research from our partners at Gong has found that more than 80% of companies have missed their revenue forecasts over the last two years.

In this blog post, we’ll look at how revenue intelligence (using a range of data points) can be used to improve the health of your pipeline and the performance of your sales team. We’ll also examine the latest B2B sales benchmarking data produced by our revenue intelligence partner Ebsta, whose analysis based on 4.2 million sales opportunities.

Data, data everywhere

The volume of data that companies produce doubles every 12-18 months. This means that your organisation has a wealth of insight, and the compound interest, at its fingertips. The problem is that many organisations don’t have a consistent approach to gathering and managing this data, partly because data collection isn’t automated.

Guy Rubin, Ebsta CEO, says: “Without the data, you’re not even at the races. You need to make sure you’ve got a strategy to ensure that you are capturing all of the data you need consistently. What I mean by ‘consistently’ is that we shouldn’t be relying on humans anymore. All of the activity that’s going on across your organisation is being captured somewhere. We need to make sure that it’s in the right system of record so that it can then be reported on.”

Standardise and centralise

As Guy says, sales and customer data is available from several sources across your business. However, many organisations (particularly those spread across several territories) don’t use standardised terminology. For example, we have come across many cases where what is termed “a lead” by the EMEA team may be described as a “prospect” by the US salesforce.

If you want to measure how long it takes to turn a lead into a closed deal, it’s the equivalent of timing a 100m sprint where half the competitors have started 10 metres in! So it’s imperative to understand what the stages of the customer life cycle are across your organisation.

As Alan Morton, co-managing director of SBR, says: “You need to define and have commonality around language to forecast effectively. What matters is everyone in the organisation is forecasting the same way.”

You also need to find a way of centralising and collecting your data. In the age of “digital first” and artificial intelligence (AI) this has never been easier.

Data analysis with AI

By using a plug-in tool (such as Ebsta), your company can easily collect and centralise the data that impacts winning and retaining business. This includes everything from the number of emails that are sent to a prospect, the number of calls that are made and face-to-face meetings generated, to which stakeholders are engaged with, the average time a deal takes to complete, and what the potential risk factors are.

But the sales cycle doesn’t end there. You also need oversight of the onboarding process, as well as retention, upsell and cross-sell rates. Alan Morton says: “You’ve got to be thinking about all those client interaction points and making sure of the extent to which you’ve got that process mapped out, and then be able to see where you can optimise based on what the data is showing.”

So, by analysing historical data, sales leaders can get a snapshot of which aspects of the sales cycle need to be improved.

But what is the key data that you should be looking at? And what actions can be taken based on that data?

Eliminate the single point of failure

This is something we often talk about at SBR but, thanks to Ebsta, we also have the data to back it up. Too often we see our clients lose huge accounts due to “a single point of failure.” This is where the business has been won or retained due to a relationship with a sole decision-maker.

However, that person then leaves before the deal is completed (or renewed) and your main advocate is no longer there to influence the decision. This is why it’s so important to have relationships with as many stakeholders as possible.

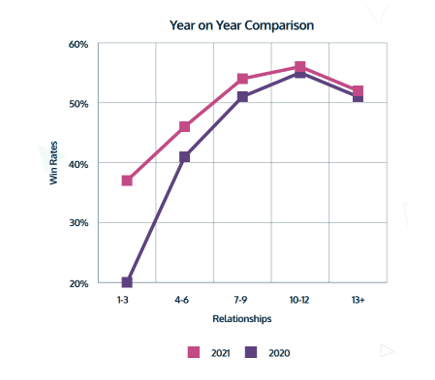

According to Ebsta’s analysis, those that have between 4-6 relationships in the organisation saw a 19% increase in win rates compared to those with just 1-3.

Those with 7-9 relationships saw 14% more wins than those with just 4-6. Opportunities with 10-12 relationships delivered the strongest win rates at 56%.

Would you find similar results if you analysed deals won over the last two years?

Increased engagement increases sales

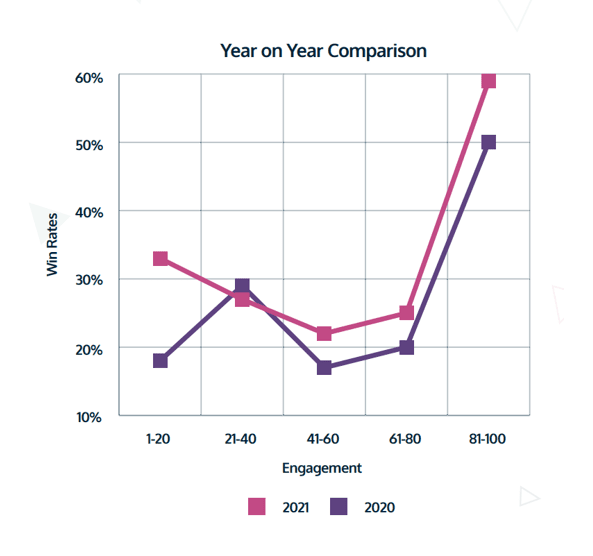

But its not just who you are engaging with that’s important, it’s the level of engagement. So what do we mean by that? Guy says: “We don’t just look at the number of stakeholders involved in historical sales, but we also try and analyse how much engagement took place. There’s a big difference between measuring activity and measuring engagement. In short, a meeting’s worth more than a call, which is worth more than an email and the direction of that activity has a big impact.”

“If you exchange a dozen emails in a day versus a dozen emails over a quarter, it’s a big difference from an engagement perspective. So we’ve effectively taken hundreds of data points together, and we distil it down to a single north star metric, which we call engagements scoring.”

What are the results of increased engagement? Using Ebsta’s metric, organisations that achieved an engagement score of 80-100 achieved a win rate of 59%. Those that had an engagement rate of 60-80 won just 25% of deals.

Increased engagement reduces the sales cycle

Not only does increased engagement lead to more sales it also helps expedite deals. Which over the long-term can have a significant impact on revenue. For example, if you work in an industry where you can only work on one deal at a time, and the sales cycle takes two months, then you are restricted to six deals a year. If that sales cycle can be reduced to six weeks, then that’s a 50% increase in business.

Guy says: “We spend a lot of time looking at what gets deals done quicker and surprise, surprise, higher levels of engagement lead to shorter sales processes.”

Discover more

Intelligent analysis of data across your organisation could have a dramatic impact on your revenue. By working alongside Ebsta we have helped our clients make incremental improvements across the sales cycle. In some cases, this has resulted in millions of dollars in extra business.

To learn more about how we have achieved this and to get more insight behind the data, take a look at our recent webinar: The critical role of revenue intelligence in sales execution. If you would like to discuss how we can get similar results for you organisation, please get in touch by emailing info@sbrconsulting.com or call us on +44 (0) 207 653 3740.

You can sign up to receive regular updates and join over 4,000 others who enjoy access to our unique research insights, expert guidance, and advice.