Think Win-Win: How to Defend Your Margin and Build Trust

It doesn’t matter where you are in the world at the moment, we’re all facing the impact of inflation.

When the cost of providing your products and services rises, it’s inevitable that you pass on the increase to customers to protect your margins. This is especially important for sales professionals, whose commissions are often based on margins rather than volume, and when it comes to maintaining your company’s equity value, which is calculated on profit.

However, initiating or reinitiating price negotiations can be daunting for your sales team when they’re constantly on the rise. In a recent poll, only 11% of sales leaders felt their team were “extremely confident” initiating challenging price negotiations, while a whopping 32% said they were not confident at all. 56% believed their team were “fairly confident”.

With market pressures showing no signs of subsiding, now is the time to equip your sales team with the skills they need to navigate these conversations with your buyers.

In this article, we discuss:

- The importance of building trust with your customers

- The principles of interest-based negotiations and the win-win mindset

- Defining your BATNA and finding a ZOPA

- Knowing where you can be flexible

The Importance of Building Trust with Your Customers

One of our clients has had to increase prices 12 times in the last 18 months due to supply and demand issues. Hiking your prices this often can damage your image and your relationship with your customers.

Right? Well, not necessarily – it’s a question of trust. And you need to be honest about whether your customers see you as a partner, fighting the same battles as you, or as someone who is purely concerned with their commission.

What systems do you have in place to maintain relationships with new and existing customers? Do you touch base with them regularly? Do you foster ongoing dialogue, which allows you to have honest conversations about upcoming changes?

In the current economic climate, you may have to increase the quantity and quality of those interactions.

Your clients are likely facing the same challenges as you are – wondering exactly how much bills and other overheads are likely to go up. So, there’s a good chance you can find common ground when it comes to price negotiations. They simply have to know and trust that you are being completely transparent about why your prices have gone up and that you have their interests in mind.

The Principles of Interest-Based Negotiation and the Win-Win Mindset

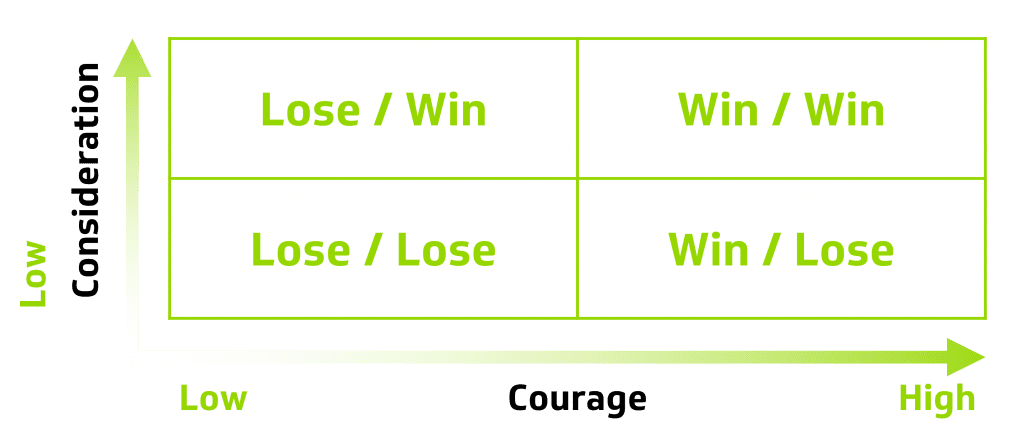

“Think win-win” is a phrase from Dr. Stephen Covey’s must-read book, The 7 Habits of Highly Effective People. In this particular chapter, he explains how the “win-lose” mindset stops us from coming up with solutions that benefit everyone involved. We tend to think that someone has to lose in order for someone else to win.

Covey’s point is that, by changing our mindset to win-win, we can work together towards meeting everyone’s interests. In business negotiations, that’s the difference between distributive bargaining and interest-based negotiation.

If your sales tactic consists of achieving high price for low value, this may be great for your short-term profits, but it’s unlikely to earn you the trust and loyalty of your buyers. A better approach is to consider your client’s interests and actively look for ways to meet them while maintaining your margin.

A skilled salesperson will be able to demonstrate the right amount of consideration for the client’s interests, while also possessing the courage the drive the negotiation forwards for a win-win outcome.

Defining Your BATNA and Finding a ZOPA

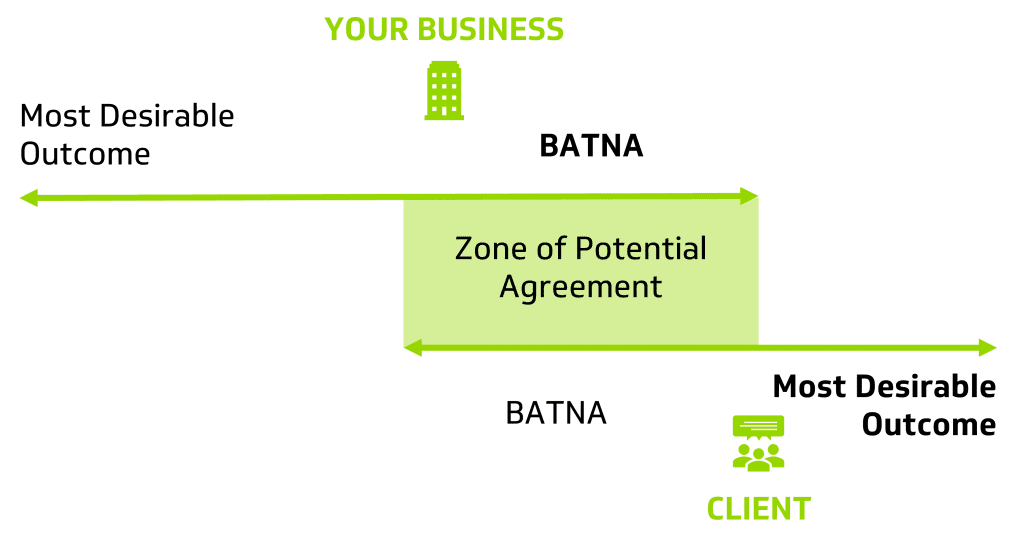

To quote Covey, “Win-win is a belief in the third alternative. It’s not your way or my way; it’s a better way, a higher way.” This better way can be achieved through a proven framework for negotiation – Finding the zone of possible agreement (ZOPA).

To find a ZOPA, you must first define your best alternative to a negotiated agreement (BATNA) and understand your customer’s. This then gives you the range of most desirable outcomes for both parties. If the two sets of interests overlap, then you’ve got yourself a ZOPA.

Let’s say you’re looking to sell your services for £1000, but could accept £850 and still be content with your margin. Your client, on the other hand, would prefer to pay as little as £800, but would go up to £950 if they feel they’re getting value for their money. Then, your ZOPA exists between £850 and £950.

Knowing Where You Can Be Flexible

Let’s be clear here – as this is about defending your margin – moving down on price or fee shouldn’t be your go-to, unless the buyer agrees to concessions too.

When there’s a change in the fee structure, discuss with your client how this will affect the scope of your product or services. If you offer a discount without any flexibility on their part, it diminishes the perceived value of your product or service. And this can erode your clients’ trust in your brand.

Instead, rethink your proposition and bundle your services to offer the best possible value for the agreed price. In case of a price increase, if your buyer is unable to pay more, you’ll have to agree on a different level of service.

For example, if your company sells bespoke packaging, you could agree to maintain the same prices for a period of time but specify that the design will no longer include embossing or you may have to look into using cheaper materials.

In Summary

Building trust with your clients has always made sense, but it’s even more important in the current climate.

Remember to think win-win in negotiations so both you and your customers walk away with the best possible deal. And be creative in the ways you bundle your products and services to maintain healthy margins.

For a more in-depth look at defending your margin in the current context, you can watch a replay of the webinar here.

To talk to us more about upskilling your sales team in closing and negotiations, get in touch by e-mailing info@sbrconsulting.com or call us on +44 (0) 207 653 3740.

At SBR, we’re dedicated to providing sales insights and sharing knowledge to help our clients accelerate their revenue. You can sign up to receive regular updates and join over 4,000 others who enjoy access to our unique research, expert guidance and advice.